What Does Medicare Supplement Plans Comparison Chart 2021 Pdf Mean?

Wiki Article

Getting The Apply For Medicare To Work

Table of ContentsBoomer Benefits Reviews Can Be Fun For EveryoneAarp Plan G Things To Know Before You BuyThe Only Guide for Aarp Plan GThe Best Guide To Medicare Part G

Usage Method B for earnings and also possessions. Keep in mind: If people that are also qualified for MA meet more than one basis of eligibility, they may select one of the most beneficial basis for MA, however must utilize a Method B basis for the Medicare Cost Savings Program. Property Guidelines Possession limitation is: l $10,000 for a household of one.

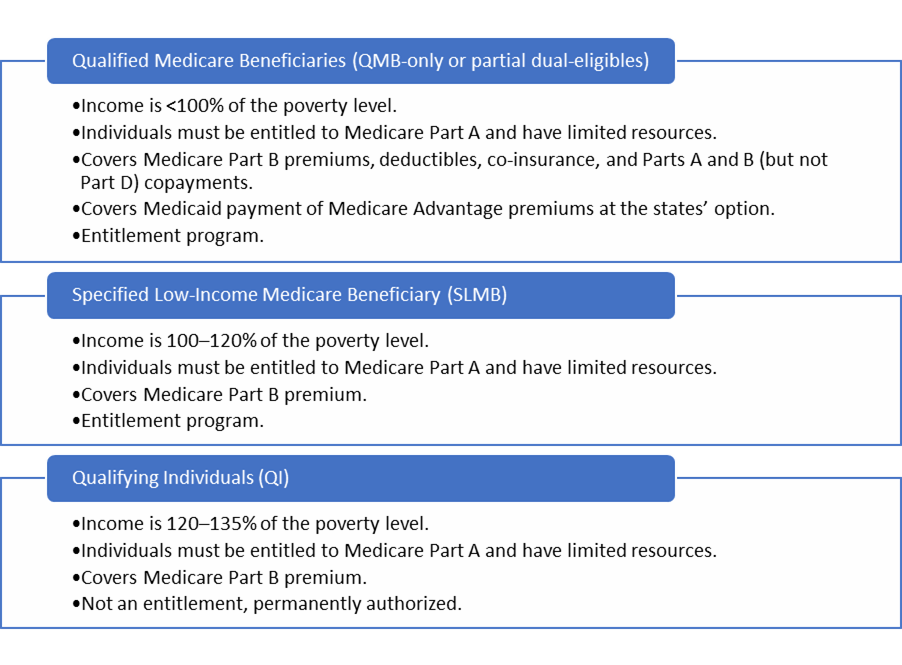

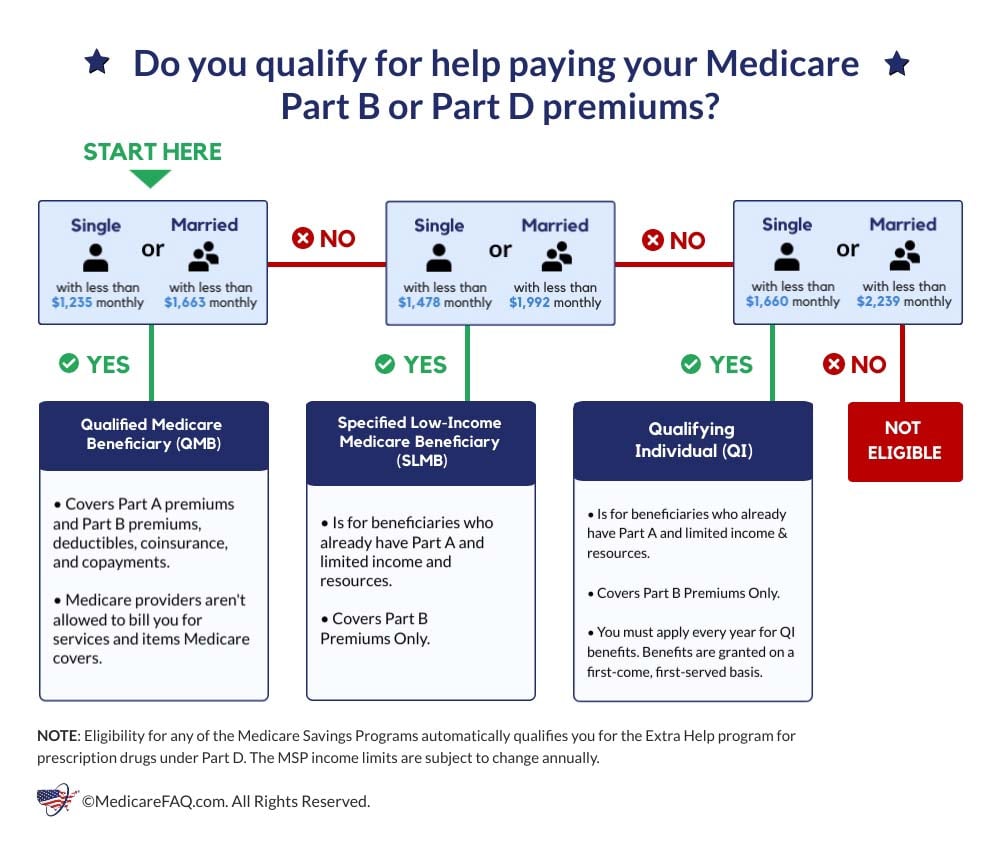

Instance: Bud's earnings is 125% FPG. He is disqualified for QMB even if he has actually covered expenses that would permit him to spend down to 100% FPG. Covered Provider (Prepaid MHCP Manual) The benefits of the QMB program are: l Settlement of Medicare Part An as well as Component B premiums. l Repayment of Medicare cost-sharing (co-payments and also deductibles) for Medicare solutions supplied by Medicare-eligible companies.

It is seldom useful for people in LTC to be QMB-only due to the fact that: l Medicare Component A covers really minimal competent nursing treatment. l Settlement may not be confirmed until several months after the care is obtained. If you know Medicare Part A is covering any of the LTCF expenses, it is beneficial for people to be QMB-only due to the fact that there would not be an LTC spenddown.

Medicare Supplement Plans Comparison Chart 2021 Things To Know Before You Buy

Individuals may get MA and QMB simultaneously. l People with incomes at or under 100% FPG get approved for QMB, and likewise for MA without a spenddown if their assets are within MA restrictions. l Since QMB allows a basic $20 revenue disregard as well as MA does not, individuals with incomes over 100% FPG however no more than 100% FPG + $20 are within the QMB earnings limit however need to meet a spenddown to certify for MA.

Medicare Savings Programs (MSP) help individuals with restricted revenue and also sources pay for some or all of their Medicare premiums and may additionally pay their Medicare deductibles and also co-insurance. There are 4 different types of Medicare Cost savings Programs, this page focuses on the Certified Medicare Recipient (QMB) Program.

Little Known Facts About Boomer Benefits Reviews.

See the Conveniences and Services Overview for a checklist of Health and wellness First Colorado co-pays. Exactly how To Apply Where Do I Obtain These Solutions? You can go to any type of medical professional that approves both Medicare as well as Health and wellness First Colorado coverage. See our Find a Medical professional page to look for Wellness First Colorado carriers.The member's benefits are limited to settlement of the participant's Medicare Part B costs just. Suppliers ought to tell the member that the solution is not a Medicaid-covered service for a member that has just SLMB coverage. When the EVS recognizes a participant as having only Specified Reduced Revenue Medicare Recipient coverage (without also having Full Medicaid or Bundle A coverage), the company ought to contact Medicare to verify medical insurance coverage.

When the EVS identifies a participant as having Defined Reduced Earnings Medicare Beneficiary insurance coverage as well as also Complete Medicaid or Package A coverage (without waiver obligation), Medicaid claims for solutions not covered by Medicare has to be submitted as normal Medicaid insurance claims and also not as crossover insurance claims. The participant's benefit is payment of the member's Medicare Component B premium.

The participant's benefit is settlement of the member's Medicare Component A premium. The EVS recognizes this insurance coverage as Competent Medicare Recipient - medicare plan g vs f.

The 7-Second Trick For Medicare Part C Eligibility

Yearly adjustments in the FPL mean that, even if you could not have gotten approved for pop over to these guys QMB in 2015, under the brand-new FPL, you may be able to qualify this year. To get the QMB program, you will certainly need to call your local state Medicaid office. For more help, you may want to call your local State Wellness Insurance coverage Assistance Program (SHIP) - apply for medicare.

SPAPs are state-funded programs that give low-income and medically clingy seniors as well as people with impairments economic assistance for prescription medications. medicare plan f. We have SPAP information online right here (note that the SPAP info is subject to change without notification): If you do not satisfy the low-income monetary requirements to get the QMB program, you still may have several of your Medicare prices covered by one of the other Medicare Savings Programs.

Example of individual requesting Premium-Part An and Component B enrollment throughout an enrollment period: Ms. Adler resides in Pennsylvania (a Component A Buy-In State) and does not have Medicare. She calls her regional FO in January 2018 since she wants Medicare insurance coverage yet can't pay for the costs.

Adler may file an application for "conditional registration" in Premium-Part A. Due to the fact that Ms. Adler stays in a Part A Buy-in State, the Component B and also conditional Part An enrollment can be filed at any type of time. The application is not processed as a General Enrollment Duration (GEP) application. The FO takes the application and refines it according to instructions in HI 00801.

Report this wiki page